What is a Credit Score?

A credit score is a number generated by a mathematical formula that is meant to predict credit worthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to get a loan. The lower your score is, the less likely you are to get a loan. If you have a low credit score and you do manage to get approved for credit then your interest rate will be much higher than someone who had a good credit score and borrowed money. Therefore, having a high credit score can save many thousands of dollars over the life of your mortgage, auto loan, or credit card.

Who calculates my Credit Scores & generates my Credit Reports?

Every person has THREE Credit Reports & corresponding Credit Scores. Each is generated by one of the 3 major Credit Reporting Agencies or Bureaus.

They are Equifax, TransUnion, & Experian.

They are Equifax, TransUnion, & Experian.

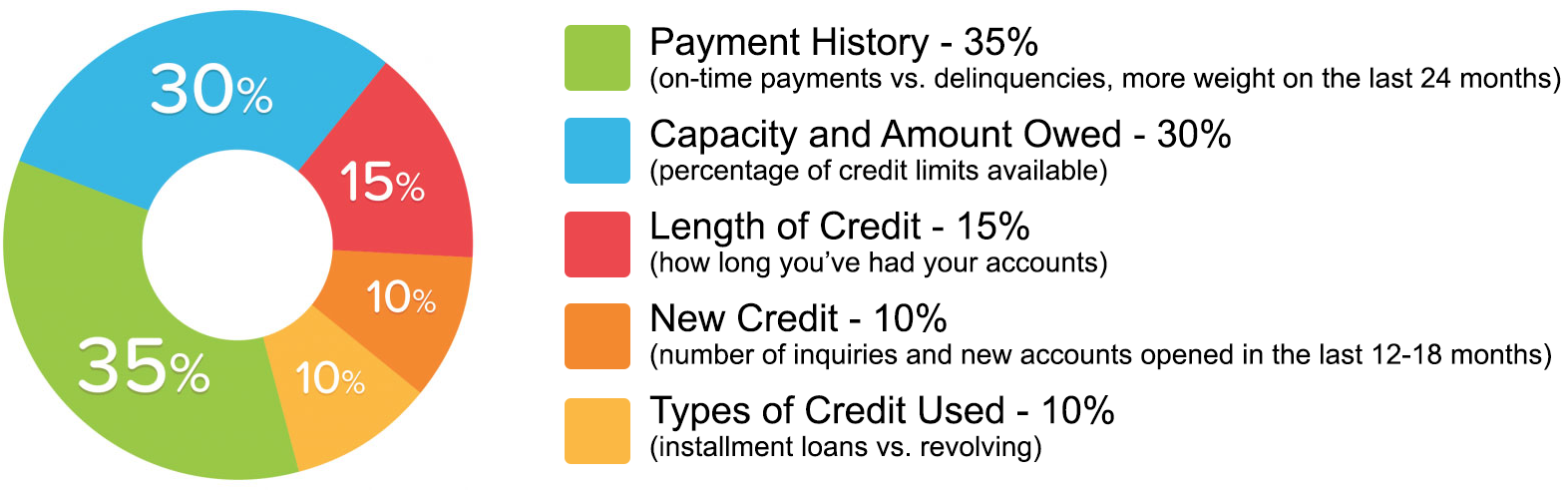

How is my Credit Score calculated by the Bureaus?

Here are just a few tips on how to improve your practices in all of the 5 above listed categories:

PAYMENT HISTORY:

- Be careful & diligent in your practices if you pay your credit accounts online. If the bank makes a mistake resulting in your payment not being made on time, the Bureaus' opinion is that it is still YOUR fault.

- Pay your bills WELL before their due date when possible to ensure if there is an issue that it may be corrected prior to the account being delinquent.

- Educate yourself about the billing cycles, due dates, limits, & minimum payments on ALL of your cards.

CAPACITY AND AMOUNT OWED:

- Be very aware of your card limits, & try to keep your balance below 20% of your limit or lower whenever possible. It is especially important to do this on cards with LOW limits. Remember that this portion takes into account Balance vs Limit percentage, regardless of how small the dollar amount is.

- If it's a necessity to use a large amount of your credit limit on a monthly basis, make more than one payment per month even if you pay your card(s) in full at the end of the billing cycle. This way at the end of the billing cycle, your balance will be significantly less than if you'd waited until the end of the billing cycle to pay. Most Creditors will allow you to make as many payments per month as you'd like, but check with your specific Creditor for their policies.

- Requesting a Credit Limit Increase is a good way to reduce your Balance vs Limit percentage without paying any money to the Creditor.

LENGTH OF CREDIT:

- Do NOT close old cards, even if you don't use them. It's better to keep them open, and use them once every few months on very small transactions. This will keep those accounts open, continuing to report good pay history on your Credit Report, & conveys to the Bureaus that you have the ability to borrow, but you're so financially sound that you rarely need to.

- If you only have accounts with a very short history, but you've paid Utility Bills for far longer, you may be applicable to take advantage of the Experian Boost Program. (Feel free to reach out to one of our agents for more information on this)

- Adding yourself as an Authorized User to a friend or family member's Credit Card with a long pay history could help you show a longer body of work on your Credit Report. Be careful if taking this route though, because the way the Primary Card Holder handles their account will directly impact your Credit Report.

- If you have a lack of credit or NO credit, Secured Credit Cards can be a great avenue to start developing some account history. These cards are intended for people with damaged or a lack of credit, so your chances of Approval will be far higher than applying for a standard Credit Card.

NEW CREDIT:

- Only apply for credit when you have firmly decided you want the product. Do not apply "just to see if you could get it."

- If someone requests to run a Credit Report for you, ask if they can accept a report you provide to them. There are several Credit Monitoring Companies such as SmartCredit that can give you access to a 3 Bureau Report with Scores. Products like these are outstanding tools for tracking your Credit, having anytime access to Reports & Scores, and there is NO credit inquiry reported.

- Review your Credit Inquiries frequently to ensure that nobody has ran a Credit Report for you in the past 2 years without your authorization.

TYPES OF CREDIT USED: (sometimes referred to as your "Credit Mix")

- If you only have Installment Accounts (Mortgage, Auto Loan, Fixed Line of Credit, Etc), add one or two small Credit Cards to be used sparingly.

- If you only have Revolving Accounts (Credit Cards, Revolving Line of Credit, Etc), you may add one or two small Fixed line of credit products. Do NOT go buy an Automobile or Mortgage Property for the sole purpose of gaining a new Installment Account. The goal is not to take on a large new debt liability, but rather to take a small loan (of which you do not spend), and use the loaned money to make your loan payments. So the only expense to you will be the interest.

How long will certain items remain on my Credit Report?

(Statute of Limitations)

- Delinquencies (30- 180 days): A delinquency may remain on file for seven years; from the date of the initial missed payment.

- Collection Accounts: May remain seven years from the date of the initial missed payment that led to the collection (the original delinquency date). When a collection account is paid in full, it will be marked as a "paid collection" on the credit report.

- Charge-off Accounts: When a delinquent account is sent to a collections company. This will remain for seven years from the date of the initial missed payment that led to the charge-off (the original delinquency date), even if payments are later made on the charge-off account.

- Closed Accounts: Closed accounts are no longer available for further use and may or may not have a zero balance. Closed accounts with delinquencies remain for seven years from the date they are reported closed, whether closed by the creditor or by the consumer. However, the delinquency notation will be removed seven years after the delinquency occurred when pertaining to late payments. Positive closed accounts continue to be reported for ten years from the closing date.

- Lost Credit Card: If there are no delinquencies, credit cards reported as lost will continue to be listed for two years from the date the creditor is contacted. Delinquent payments that occurred before the card was lost are reported for seven years.

- Bankruptcy: Chapters 7, 11, and 12 will remain on one's credit report for ten years from the filing date. A Chapter 13 bankruptcy is reported for seven years from the filing date. Accounts included in a bankruptcy will remain for seven years from the date reported as included in the bankruptcy

- Judgments: Remain seven years from the date filed.

- City, County, State, and Federal Tax Liens: Unpaid tax liens remain for fifteen years from the filing date. A paid tax lien will remain on one's score for 10 years from the date of payment.

- Inquiries: Most inquiries listed on one's credit report will remain for two years. All inquiries must remain for a minimum of one year from the date the inquiry was made. Some inquiries, such as employment or pre-approved offers of credit, will show only on a personal credit report pulled by you.